Welcome, dear reader, to the wild and wacky world of Value Added Tax (VAT)! Yes, you heard it right, we’re diving headfirst into the thrilling, roller-coaster ride of tax services. Buckle up, because it’s going to be a riotous journey!

Now, we know what you’re thinking: “Taxes? Hilarious? You’ve got to be kidding!” But trust us, with the right perspective, even the driest of subjects can become a laugh riot. So, let’s embark on this exciting adventure together, shall we?

The Basics of Value Added Tax (VAT)

Imagine you’re at a party, and every time you add a new ingredient to the punch, you have to pay a little extra. That’s VAT in a nutshell! It’s a type of tax that’s added at each stage of production or distribution of a product or service. Sounds fun, right? We thought so!

But wait, there’s more! VAT is also known as a consumption tax because it’s ultimately borne by the final consumer. It’s like a game of hot potato, but with tax. The tax gets passed along the supply chain until it reaches the final consumer, who can’t pass it on any further. Talk about a party foul!

How VAT Works

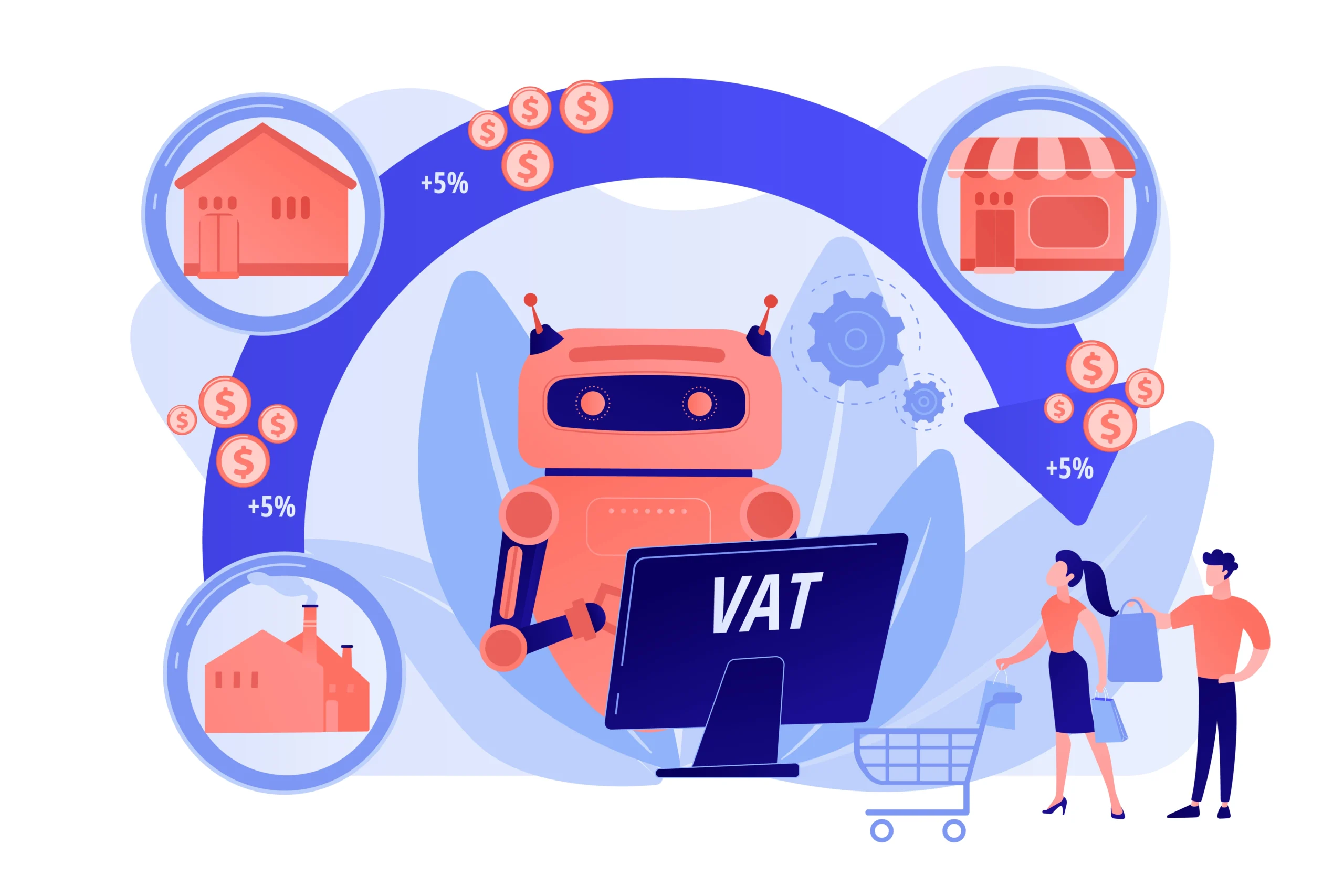

Now, let’s get into the nitty-gritty of how VAT works. Picture a relay race, but instead of a baton, you’re passing on tax. Each participant in the supply chain (from the raw material supplier to the retailer) charges VAT on their sales, but can also reclaim the VAT they’ve paid on their purchases. It’s like a game of tag, but with tax. Fun, right?

At the end of the tax period, each business must calculate the VAT they’ve charged on their sales (output VAT), subtract the VAT they’ve paid on their purchases (input VAT), and pay the difference to the tax authorities. It’s like a math problem, but with tax. And who doesn’t love math problems?

Types of VAT Rates

Just when you thought VAT couldn’t get any more exciting, we’re here to tell you about the different types of VAT rates! There’s the standard rate, which is the default VAT rate applied to most goods and services. It’s like the main character in our VAT story.

Then there’s the reduced rate, which is a lower rate applied to certain goods and services. It’s like the supporting character who occasionally steals the spotlight. And finally, there’s the zero rate, which is applied to certain goods and services but allows businesses to reclaim the VAT they’ve paid on their purchases. It’s like the plot twist in our VAT saga!

The Role of VAT in Business Tax Services

Now, let’s switch gears and talk about the role of VAT in business tax services. You might be wondering, “Why should I care about VAT?” Well, if you’re a business owner, VAT can have a significant impact on your bottom line. It’s like a surprise guest at your party who can either make or break the event.

Business tax services can help businesses navigate the complex world of VAT. They can provide advice on VAT registration, planning, and compliance, and can help businesses reclaim the VAT they’ve paid on their purchases. It’s like having a tax superhero on your side!

VAT Registration

First up in our VAT adventure is VAT registration. This is the process of registering a business with the tax authorities for VAT purposes. It’s like sending out invitations to your tax party. Some businesses are required to register for VAT, while others can choose to register voluntarily. It’s like deciding who gets to come to your party.

Business tax services can help businesses determine whether they need to register for VAT, and can assist with the registration process. They can also provide advice on the advantages and disadvantages of voluntary registration. It’s like having a party planner for your tax event!

VAT Planning and Compliance

Next on our VAT journey is VAT planning and compliance. This involves planning for VAT liabilities and ensuring that a business complies with VAT laws and regulations. It’s like planning the menu for your tax party and making sure everyone follows the party rules.

Business tax services can help businesses plan for their VAT liabilities, prepare and submit VAT returns, and ensure that they comply with all VAT laws and regulations. They can also provide advice on how to minimize VAT liabilities and avoid penalties. It’s like having a party host who takes care of everything!

VAT Reclaim

Last but not least in our VAT adventure is VAT reclaim. This is the process of reclaiming the VAT that a business has paid on its purchases. It’s like getting a refund for the party supplies you bought.

Business tax services can help businesses reclaim the VAT they’ve paid on their purchases, and can provide advice on the reclaim process. They can also assist with VAT audits and disputes. It’s like having a party guest who helps clean up after the event!

Conclusion

And there you have it, folks! That’s VAT in a nutshell. We hope you’ve enjoyed this hilarious journey through the world of Value Added Tax and business tax services. Remember, taxes may seem daunting, but with the right perspective (and a good sense of humor), they can be a lot of fun!

So, the next time you’re at a party and someone brings up the topic of taxes, don’t shy away. Instead, regale them with your newfound knowledge of VAT. Who knows, you might just be the life of the party!