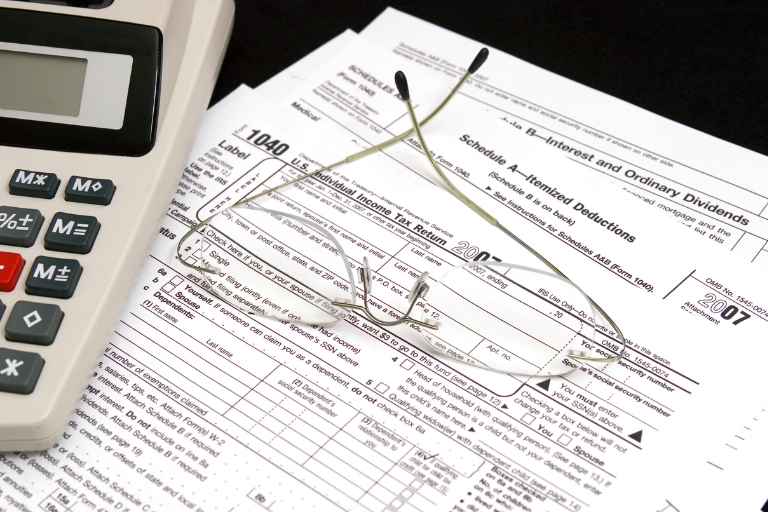

Welcome, dear reader, to the wild and wacky world of itemized deductions! If you thought tax planning was all about dull numbers and tedious paperwork, prepare to have your mind blown! This isn’t just about saving money, it’s about embarking on an epic adventure through the labyrinthine corridors of the tax code. Buckle up, because it’s going to be a wild ride!

Itemized deductions are like the secret weapons in your tax planning arsenal. They’re the hidden treasures, the magic spells, the power-ups that can help you level up your tax game. But like any good video game, the rules can be complex and the challenges can be tough. That’s why we’re here to guide you through it, with all the humor and hilarity that tax planning truly deserves.

The Basics of Itemized Deductions

So what exactly are itemized deductions? Well, imagine you’re a pirate, sailing the high seas of income. The treasure you’ve amassed is your gross income. But wait! There’s a giant sea monster called the IRS, and it wants a piece of your treasure. The more treasure you give it, the less you have for yourself. That’s where itemized deductions come in. They’re like cannons you can fire at the sea monster, reducing the amount of treasure it can take.

Itemized deductions are expenses that you can subtract from your gross income, reducing your taxable income. They can include things like mortgage interest, state and local taxes, medical expenses, and charitable contributions. But before you start firing those cannons, you need to know the rules of the game. Not all expenses can be deducted, and there are limits to how much you can deduct. But fear not, brave pirate, we’ll guide you through it!

Types of Itemized Deductions

Itemized deductions come in all shapes and sizes, like the various power-ups in a video game. Some are common, like coins in a Mario game, while others are rare, like the invincibility star. Let’s take a look at some of the most common types of itemized deductions.

First up, we have mortgage interest. If you’re a homeowner, the interest you pay on your mortgage can be deducted from your taxable income. It’s like a shield that can protect your treasure from the IRS sea monster. But remember, only the interest is deductible, not the principal. So if you’re paying off your mortgage, make sure you know how much of your payment is going towards interest.

Medical and Dental Expenses

Next, we have medical and dental expenses. If you’ve had to shell out for medical or dental care, you might be able to deduct those expenses from your taxable income. It’s like a health potion that can restore your treasure after a battle with the IRS sea monster. But be careful, there’s a catch. Only the amount that exceeds 7.5% of your adjusted gross income can be deducted. So if your medical expenses aren’t high enough, you won’t be able to use this power-up.

Charitable contributions are another type of itemized deduction. If you’ve been generous and donated to a qualified charity, you can deduct those donations from your taxable income. It’s like a karma power-up, rewarding you for your good deeds. But again, there are limits. You can only deduct up to 60% of your adjusted gross income for cash donations, and there are different limits for non-cash donations.

Choosing Between Standard and Itemized Deductions

Now, you might be thinking, “Great, I’ll just deduct everything and pay no taxes!” But hold your horses, eager beaver. There’s a twist in this game. You see, there’s another type of deduction called the standard deduction. It’s like a fixed power-up that you can use instead of itemized deductions. The standard deduction is a fixed amount that you can subtract from your income, no questions asked.

The tricky part is, you can’t use both the standard deduction and itemized deductions. You have to choose one or the other. It’s like choosing between a sword and a bow in a video game. Both are useful, but you can only use one at a time. So how do you choose? Well, you’ll want to compare the total amount you can deduct with itemized deductions to the standard deduction. If your itemized deductions are higher, go with those. If not, take the standard deduction.

How to Calculate Your Itemized Deductions

Calculating your itemized deductions can be a bit like solving a puzzle. You’ll need to gather all your expenses that qualify as itemized deductions, add them up, and compare the total to the standard deduction. If your itemized deductions are higher, congratulations! You’ve unlocked the itemized deduction power-up!

But remember, not all expenses qualify as itemized deductions. And even for those that do, there are often limits or thresholds that must be met. So make sure you understand the rules before you start adding up your expenses. And keep good records! The IRS sea monster loves to audit taxpayers who claim large itemized deductions without proper documentation.

Itemized Deductions and Tax Planning

So how do itemized deductions fit into your overall tax planning strategy? Well, they can be a powerful tool for reducing your taxable income and lowering your tax bill. But like any tool, they need to be used wisely. If you’re not careful, you could end up overusing itemized deductions and triggering an audit.

That’s why it’s important to have a tax planning strategy. This involves understanding the tax code, keeping good records, and making smart decisions about when and how to use itemized deductions. It’s like playing a strategic video game. You need to understand the rules, plan your moves, and adapt to changing circumstances. And with a little luck and a lot of skill, you can defeat the IRS sea monster and keep more of your treasure!

Conclusion

And there you have it, folks! The thrilling, hilarious, and surprisingly complex world of itemized deductions. We hope you’ve enjoyed this journey through the tax code as much as we have. Remember, tax planning isn’t just about saving money, it’s about understanding the rules of the game and making smart decisions. So go forth, brave tax pirates, and conquer the IRS sea monster!

And remember, if you ever feel lost in the labyrinthine corridors of the tax code, don’t hesitate to seek help. There are plenty of tax professionals out there who can guide you through the process. They might not be as hilarious as us, but they’re definitely more knowledgeable. So until next time, happy tax planning!